GCC Residential Real Estate Market

GCC Residential Real Estate Market Overview

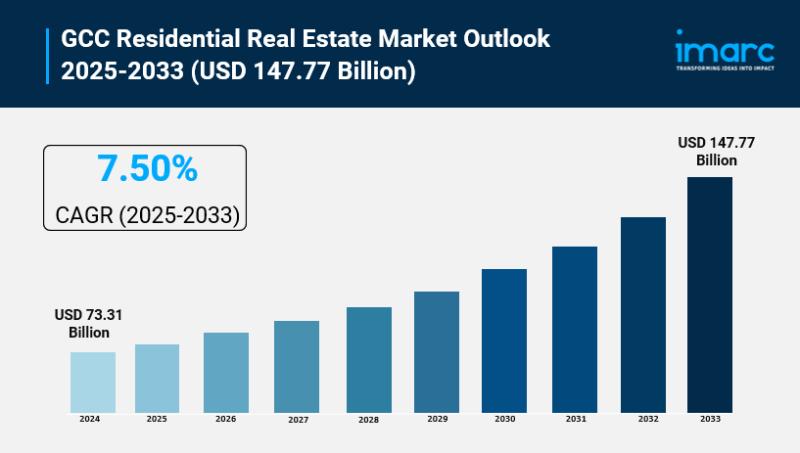

Market Size in 2024: USD 73.31 Billion

Market Size in 2033: USD 147.77 Billion

Market Growth Rate 2025-2033: 7.50%

According to IMARC Group’s latest research publication, “GCC Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the GCC residential real estate market size was valued at USD 73.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.77 Billion by 2033, exhibiting a CAGR of 7.50% from 2025-2033.

How AI is Reshaping the Future of GCC Residential Real Estate Market

● AI-Powered Property Search: AI platforms like Property Finder personalize home searches, boosting GCC sales by 25% with virtual tours for 70% of Dubai buyers.

● Smart Home Integration: AI-driven IoT systems in UAE villas optimize energy use by 20%, aligning with Vision 2030’s $852 billion smart city projects.

● Predictive Market Analytics: AI forecasts demand in Saudi’s $64.5 billion market, reducing investment risks by 15% for developers in NEOM.

● Automated Valuation Models: AI tools assess property values in real-time, improving accuracy by 30% for Qatar’s luxury real estate transactions.

● Construction Efficiency: AI optimizes building processes, cutting costs by 18% in Riyadh’s eco-friendly residential projects under green initiatives.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-residential-real-estate-market/requestsample

GCC Residential Real Estate Market Trends & Drivers:

Smart home technologies drive 30% of GCC residential real estate demand, with IoT-integrated properties in UAE and Saudi Arabia enhancing energy efficiency by 25%. Vision 2030’s $852 billion infrastructure projects, like NEOM, boost urban residential developments, with 70% of buyers prioritizing connected homes. E-commerce platforms like Property Finder leverage AI for virtual tours, increasing sales by 20% in Dubai and Riyadh, catering to a tech-savvy population and aligning with the region’s $2.8 trillion wealth growth for modern living solutions.

Sustainable and green building practices fuel 25% of residential market growth, as UAE’s Green Agenda and Saudi Arabia’s net-zero goals push eco-friendly designs. Developments with solar panels and recycled materials attract 60% of millennial buyers, reducing utility costs by 15%. Government incentives, including $1 billion in sustainability funds, support green certifications, while 80% of new projects in Jeddah incorporate energy-efficient systems, aligning with environmental regulations and appealing to the GCC’s environmentally conscious urban demographic.

Urbanization and tourism growth propel 40% of residential demand, with the GCC market valued at $64.5 billion. Saudi Arabia’s unified GCC visa and 150 million annual visitors drive housing needs in tourist hubs like Dubai, backed by 6% annual expansion. Mega-projects like Qiddiya increase property investments, with 65% of transactions for luxury villas and apartments, catering to high-net-worth individuals and expatriates in a region with $2.8 trillion in financial wealth.

GCC Residential Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Apartments and Condominiums

● Villas and Landed Houses

Country Insights:

● Saudi Arabia

● United Arab Emirates

● Qatar

● Kuwait

● Oman

● Bahrain

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=21182&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Residential Real Estate Market

● August 2025: Omnia Capital Group’s GCC Property Wealth Report forecasts 10-15% prime residential price growth in Dubai, Abu Dhabi, and Riyadh, driven by 18,000 HNWIs relocating to the region amid sustained investor confidence.

● September 2025: Oman’s residential real estate prices surge 11.8% year-on-year in Q2, with Muscat Governorate leading at 38.1% growth in land values, supported by urbanization and infrastructure boosts.

● July 2025: Markaz’s real estate outlook predicts upward momentum in UAE, Saudi Arabia, and Kuwait markets through H2, with Dubai’s rental yields hitting 7.6% and AED 142 billion in Q1 sales.

● February 2025: Sakan releases inaugural GCC Residential Market Report, revealing $383 billion in 2024 transactions, with Qatar’s hospitality additions of 845 rooms signaling strong residential spillover effects.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Texas Real Estate Commission Consumer Protection Notice | Texas Real Estate Commission Information About Brokerage Services

Texas Real Estate Commission Consumer Protection Notice | Texas Real Estate Commission Information About Brokerage Services

Colorado mountain housing shifts to balanced market

in UncategorizedThe Colorado mountain real estate market has moved away from the intense seller’s market seen during the pandemic and is trending toward a more balanced market.

In Brief:

The transition is characterized by increased inventory, a slowdown in sales activity and a wider range of pricing trends that vary by location and property type.

Across several mountain communities, including Crested Butte, Vail, Summit County and Steamboat Springs, inventory is up — a welcome change for buyers who are finding more options and negotiation opportunities, according to the latest Market Trends Report from the Colorado Association of Realtors.

The supply of single-family homes and condos is at its highest point in years, in some cases reaching levels not seen since before the COVID-19 pandemic.

But this has also led to properties staying on the market for longer periods. For instance, single-family homes in Summit, Park and Lake counties are spending about 40% more time on the market than last year.

“Buyers have more choice,” said Dana Cottrell, a realtor with Summit Resort Group in Dillon. “People just have the time to shop around and say, ‘OK, I think that condo in Wilderness has 1,200 square feet for the same price as near the ski areas for a studio or a one bedroom. I think that when people are doing these comparisons, it takes them more time to decide what to buy.”

Sellers, in turn, are having to adjust their expectations, with many needing to offer concessions or lower their prices to attract buyers. The percentage of list price received is hovering around 97% in Steamboat Springs, a slight decrease from the high-demand periods.

Molly Eldridge, a realtor with Coldwell Banker in Crested Butte, said buyers are nervous about paying too much and sellers are reducing prices from what they were earlier in the summer.

“It seems like we’re seeing deals falling out of contract — people are backing out,” Eldridge said. “Some could be that they can’t get a loan or there’s an inspection issue. Buyers are nervous about what’s happening in the world.”

Despite the overall market slowdown, there are differences in how various areas and property types are performing.

• Crested Butte versus Gunnison: While overall sales in the broader region are up 6% through August, dollar volume is down 5%. In the Crested Butte area, both sales and dollar volume are down, while Gunnison is seeing an increase in both sales and dollar volume with condo and townhome prices surging by 73%.

This disparity is largely because of the relative affordability of Gunnison properties, with the average single-family home price being roughly one-third of that in Crested Butte.

• Single-family versus multifamily home: In Vail, single-family home sales and new listings were up in August, while the townhome/condo market was down. In Summit County, single-family homes saw a price drop of 4.9%, while multifamily properties saw a price increase of 7.2%.

In Steamboat Springs, single-family home new listings are up significantly, but sold listings have been lackluster. The number of multifamily units on the market is also much higher than last year.

• Luxury market: The high-end market remains a bright spot. While the overall market cools, luxury properties are still seeing strong demand. In Summit County, single-family homes over $10 million surged by 150% year-to-date, and properties in the $1.5 million to $2 million range climbed by 79%. Cash deals are also on the rise, accounting for 45% of all transactions in August.

l

A government shutdown seems likely — will it affect real estate?

in UncategorizedThe industry might not feel a direct impact, but a shutdown could intensify economic concerns that have slowed market activity for months. Plus: Fed, FHFA news.

Key points:

An Oct. 1 federal government shutdown seems increasingly likely — and while it wouldn’t stop some people from buying and selling homes, the economic and psychological impacts could make it harder for real estate to get back on track.

In other news out of Washington, D.C., uncertainty persists at the Federal Reserve over future rate cuts and the body’s independence, while the Federal Housing Finance Agency (FHFA) is terminating an equitable housing advisory committee, and the SEC will consider a rule change on earnings reports.

What a government shutdown could mean for real estate

If lawmakers can’t agree on how to fund the government before the Sept. 30 deadline, millions of federal employees will stop receiving their paychecks and a variety of agencies will go idle.

But many programs tied to real estate — including Fannie Mae, Freddie Mac, HUD and the VA — will continue operating, though possibly at reduced levels, and past shutdowns have shown that home sales are largely unaffected.

In a survey by the National Association of Realtors, 75% of members reported no impact on contract signings or closings during previous shutdowns, though 11% did report effects on current clients and another 11% reported effects on potential clients. The most common impact in those cases was that the buyer opted not to buy because of general economic uncertainty.

A shutdown could exacerbate existing economic woes

That uncertainty, and the wider economic impacts, are bigger concerns for the already sluggish market. Compared to previous shutdowns, this one could be more damaging to the economy, according to Redfin Economist Chen Zhao.

With President Donald Trump already suggesting mass layoffs in the event of a shutdown, “it’s possible we could see more of a direct impact this time,” Zhao said in an email. “Financial markets might react more if something unusual like that were to occur, which could create a volatile rate situation and more nervous buyers if the stock market were to drop.”

Mortgage rates tend to drop during a government shutdown, so it’s possible that 30-year rates, which ticked up slightly this week, could fall under 6%. But those who are worried about their jobs aren’t likely to buy houses, even if rates do decline.

Meanwhile, key economic data isn’t produced during a shutdown, which means the Fed’s final monetary policy decisions of the year could be tougher to predict.

Fed divided on additional rate cuts

Shutdown or no shutdown, Fed Chair Jerome Powell has maintained his stance that any future Fed actions will depend on the latest economic data. As of late September, rising inflation paired with a weakening labor market has left the central bank with “no risk-free path,” he said in a Sept. 23 speech, emphasizing that “our policy is not on a preset course.”

While analysts have predicted two more rate cuts this year, Fed Governor Michelle Bowman, who urged action months before the Fed’s first short-term interest rate cut of 2025, said on Sept. 25 that she believes three cuts total this year is still possible.

Newly confirmed Fed Governor Stephen Miran also said this week that he believes “the appropriate fed funds rate is in the mid-2 percent area, almost 2 percentage points lower than current policy.”

Fed independence ‘eviscerated’?

Another unknown for the Fed? The fate of Fed Governor Lisa Cook — and the institution itself.

Trump sought to fire Cook over mortgage fraud allegations last month. Cook, who denied the allegations and has been neither charged nor convicted of any crime, sued to keep her job days later. After an appeals court allowed Cook to retain her position while her lawsuit proceeds, Trump asked the Supreme Court to review the ruling.

If the U.S. Supreme Court allows Trump to immediately fire Fed Governor Lisa Cook, the move would “eviscerate” the central bank’s independence, Cook’s lawyers argued in a Sept. 25 court filing.

Several former Fed chairs, Council of Economic Advisers chairs and Treasury secretaries who served under both Democratic and Republican administrations signed a Sept. 25 legal brief discouraging the Court from allowing such action, arguing that it “would expose the Federal Reserve to political influences, thereby eroding public confidence in the Fed’s independence and jeopardizing the credibility and efficacy of U.S. monetary policy.”

FHFA pulls the plug on equitable housing committee

On Sept. 23, FHFA Director Bill Pulte announced his decision to terminate the Advisory Committee on Affordable, Equitable and Sustainable Housing, effective immediately.

The committee was created in 2022 to advise the FHFA on barriers to housing access and other related topics, according to the committee’s charter.

Pulte said the FHFA is instead “focused on the safety of the market and restoring the American Dream!”

An end to quarterly earnings reports?

Publicly-traded companies have provided investors with updated earnings reports every quarter since 1970 — but that may soon change, according to Paul Atkins, chairman of the SEC, who suggested that cadence “emphasizes a short-term type of thinking.”

Atkins addressed the possibility during a Sept. 19 appearance on CNBC’s “Squawk Box” days after Trump proposed reverting to a semiannual reporting schedule. “To propose a change in what our rules are now I think would be a good way forward,” Atkins said.

Unexpected Shifts? Surprises in the Long Island Real Estate Market

in UncategorizedSituated in Manhasset’s North Hills, a 7,200-square-foot home is on the market for $9.2 million. Irene Rallis of Douglas Elliman is the listing agent.

Courtesy of Douglas Elliman

As we head into the fall season, what’s the most surprising trend you’ve noticed in the local real estate market? Whether it’s unexpected buyer behavior, shifts in pricing or demand, or inventory patterns you didn’t anticipate, what’s caught your attention most — and how do you see it shaping the market moving forward?

Alana Benjamin

COMPASS

MANHASSET

In several markets in Long Island, the fall of 2025 (dare I say) feels a bit like the spring. Bidding wars are back, and active buyers are out at open houses in full force. At all price points we are seeing a surprising amount of activity for the fall market; it just seems much busier than a typical September. It feels like summer, the market took just a short break, and came roaring back into action. Normally, fall starts out with a gentle roll- as homes become listed, we will see some active buyers that are ready to pull the trigger, but we also tend to see a lot more exploratory buyers not quite ready to submit offers. I have been pleasantly surprised by the number of truly active and ready buyers are out and about this fall. Buyers are primed to move, whether they are coming out from the city as rents are rising or making moves with expanding families. The fall market of 2024 was good, but just felt a little calmer in every sense. Fall 2025 is moving and grooving, and I hope it will translate into a busy 2026!

Tara Fox

DANIEL GALE SOTHEBY’S INTERNATIONAL REALTY

GREENVALE

This fall, the clearest trend is the growing preference for turnkey, renovated, move-in-ready homes. Buyers are gravitating toward properties with modern kitchens, refreshed bathrooms, new flooring, and well-maintained systems, including roofs and HVAC. Buyers want homes where they can literally bring their toothbrushes, clothes and start living, no major updates or repairs required. Even modest upgrades, such as a fresh coat of paint or updated lighting, can make a home feel current and significantly more appealing. In past markets, buyers might have budgeted to renovate after closing, but today many buyers are unwilling to take on that risk or expense. Homes are still selling for more than asking on average, with sold-to-list ratios above 100%, and inventory remains tight at just over three months of supply. Yet those numbers mask a clear divide: the best-presented and market-aligned priced homes are moving quickly, while properties needing obvious work or priced aspirationally are sitting on the market. Looking ahead, both presentation and pricing will be the key differentiators. Sellers can no longer rely on location or lot size alone. Today’s buyers expect turnkey homes that align with their lifestyle. Sellers who invest in thoughtful updates and smart pricing strategies will capture attention, stand out, and achieve the strongest results.

Irene Rallis

DOUGLAS ELLIMAN

MANHASSET

This fall, the most surprising trend in the North Shore luxury market has been the resilience of buyer demand, even with higher interest rates and broader economic uncertainty. The biggest shift has been how quickly updated, move-in-ready homes are trading, often with multiple offers at the top end of the market. At the same time, inventory remains limited, which has helped keep prices strong across several neighborhoods. What stands out is that buyers are showing less hesitation than expected— they’re willing to move decisively when the right home comes along, especially if it offers modern design, high-end finishes, or a turnkey experience. Looking ahead, I see this shaping the market in two key ways: sellers who invest in preparing and presenting their homes thoughtfully will continue to achieve exceptional results, while buyers will need to stay agile and act quickly to compete for the best properties.

Ryan Springer

THE CORCORAN GROUP

CUTCHOGUE

I have found that the secondary vacation home market has shifted dramatically in recent years. Today’s buyers are no longer looking for fixer-uppers or rustic retreats. Instead, they want modern homes that have the latest and greatest amenities and are truly move-in ready. Features like state-of-the-art kitchens, resort-style pools, and thoughtfully designed outdoor living spaces have become must-haves. Convenience is key, and buyers are willing to pay top dollar for houses that deliver all the bells and whistles without the need for renovations or updates. Turnkey homes that combine modern design with luxury amenities are in highest demand, reflecting a lifestyle-driven approach where relaxation and enjoyment can begin on day one. This presents an opportunity for investors who seek to renovate existing properties for resale. For current homeowners, investment in upgrades that will improve their quality of life in the near term – if done well – will also likely pay dividends down the road.

Claudia Alvarez

THE AGENCY

BAY SHORE

As we head into fall, Nassau County’s housing market remains active and competitive. The median sale price for single-family homes has climbed to approximately $875,000, with homes continuing to sell at or above asking price. Properties are moving quickly, averaging just 35 days on the market, reflecting ongoing buyer demand. However, inventory remains limited. Both active listings and new listings are down year-over-year, putting upward pressure on prices. This tight supply is especially felt in high-demand areas.As borrowing costs inch downward, more buyers may find room to act. That said, affordability remains a key consideration: rising prices still stretch many budgets. Nassau has also seen an increase in foreclosure filings, signaling financial stress for some homeowners. The trajectory of interest rates, new listing volume, and broader economic conditions will heavily influence the market this fall. While the environment still leans toward sellers, shifting factors may open windows of opportunity for buyers — especially if rates continue to soften or inventory expands. Whether you’re buying, selling, or just exploring your options, I’m here to provide expert guidance and local insight every step of the way.

Email tvecsey@danspapers.com with comments, questions, or tips. Follow Behind The Hedges on X and Instagram.

Canada’s housing market is primed for buyers, but many are holding off

in UncategorizedCanada’s housing market is tilting in buyers’ favour due to falling interest rates, rising inventory levels and declining home prices, but many are still choosing to delay their purchases, according to a new report by Royal LePage.

The report said 13 per cent of the 2,500 residents surveyed across Canada are actively trying to buy their first home within the next two years, but 82 per cent are planning to hold off for at least another year.

Some are ahead of others in the purchasing process: 51 per cent are researching neighbourhoods where they can afford to live, 49 per cent are browsing online listings, 19 per cent are viewing homes listed for sale in person and 19 per cent have engaged with a real estate agent.

“Interest rates are trending lower and prices have stabilized or even softened in some markets, creating favourable conditions for long-awaited entry into homeownership, especially in costly cities like Toronto and Vancouver. Yet, hesitation remains,” Phil Soper, chief executive of Royal LePage, said in a release. “Buying a home is the biggest financial decision most people will ever make, and first-time buyers naturally want to do so with as much certainty as possible.”

A separate Royal LePage survey of real estate agents said that despite more favourable market conditions, only 36 per cent reported an increase in first-time homebuyer activity this year, while a quarter reported no change.

“For some, ongoing economic uncertainty, particularly surrounding trade relations with the United States, is prompting them to hold off until there are signs of stability,” Soper said. “Others are choosing to wait in hopes of securing a better deal. With the potential for further rate cuts from the Bank of Canada this year, those in no rush to purchase now are taking a methodical approach — building up their savings and deliberately planning their entry into the market when they feel the timing is best for them.”

Despite the higher price tag, 49 per cent of first-time buyers are aspiring to buy a detached home compared to 26 per cent who intend to purchase a condominium or apartment.

“The dream of a first home often collides with budget reality. While most aspire to own a detached house, affordability often dictates a more modest starting point,” Soper said.

The typical budget for 55 per cent of first-time buyers, according to Royal LePage real estate agents, was between $500,000 and $750,000, while 19 per cent had a budget between $300,000 and $500,000.

But 41 per cent are relying on financial support to make their purchase, despite affordability improving in several markets over the past year. Amongst those individuals, 29 per cent expect a lump sum with no repayment expected, 28 per cent will have a family member or friend co-signing their mortgage loan, 27 per cent want a loan from family and friends that they will pay back and 26 per cent expect to receive financial assistance towards their monthly mortgage payments.

“Despite improving affordability, many first-time buyers continue to rely on family financial support,” Soper said. “For some buyers, financial contributions from family can make the decisive difference between becoming a homeowner and remaining a tenant.”

Sign up here to get Posthaste delivered straight to your inbox.

Starbucks Corp.’s stock was down eight per cent this year as of Wednesday’s close, compared with a 13 per cent increase in the S&P 500 Index. One reason for the muted reaction could be that the company said during its last earnings call that cuts may be coming, according to Bloomberg Intelligence analyst Michael Halen. — Bloomberg

Alberta Premier Danielle Smith delivers a keynote speech on pioneering small modular nuclear reactors in Edmonton

Today’s Data: Canada monthly real GDP for July, Ottawa’s fiscal monitor for July, U.S. personal income and consumption for August and University of Michigan consumer sentiment index

The disability tax credit is a non-refundable tax credit that is intended to recognize the impact of various non-itemizable disability-related costs. For 2025 the value of the federal credit is $1,521 but add the provincial tax savings and the combined annual value can be up to $3,243, depending on the value of the provincial credit. However, not every disability qualifies and there are specific criteria depending on the type of disability. Find out more.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at wealth@postmedia.com with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Noella Ovid with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

GCC Residential Real Estate Market Size to Worth USD 147.77

in UncategorizedGCC Residential Real Estate Market

GCC Residential Real Estate Market Overview

Market Size in 2024: USD 73.31 Billion

Market Size in 2033: USD 147.77 Billion

Market Growth Rate 2025-2033: 7.50%

According to IMARC Group’s latest research publication, “GCC Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the GCC residential real estate market size was valued at USD 73.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.77 Billion by 2033, exhibiting a CAGR of 7.50% from 2025-2033.

How AI is Reshaping the Future of GCC Residential Real Estate Market

● AI-Powered Property Search: AI platforms like Property Finder personalize home searches, boosting GCC sales by 25% with virtual tours for 70% of Dubai buyers.

● Smart Home Integration: AI-driven IoT systems in UAE villas optimize energy use by 20%, aligning with Vision 2030’s $852 billion smart city projects.

● Predictive Market Analytics: AI forecasts demand in Saudi’s $64.5 billion market, reducing investment risks by 15% for developers in NEOM.

● Automated Valuation Models: AI tools assess property values in real-time, improving accuracy by 30% for Qatar’s luxury real estate transactions.

● Construction Efficiency: AI optimizes building processes, cutting costs by 18% in Riyadh’s eco-friendly residential projects under green initiatives.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-residential-real-estate-market/requestsample

GCC Residential Real Estate Market Trends & Drivers:

Smart home technologies drive 30% of GCC residential real estate demand, with IoT-integrated properties in UAE and Saudi Arabia enhancing energy efficiency by 25%. Vision 2030’s $852 billion infrastructure projects, like NEOM, boost urban residential developments, with 70% of buyers prioritizing connected homes. E-commerce platforms like Property Finder leverage AI for virtual tours, increasing sales by 20% in Dubai and Riyadh, catering to a tech-savvy population and aligning with the region’s $2.8 trillion wealth growth for modern living solutions.

Sustainable and green building practices fuel 25% of residential market growth, as UAE’s Green Agenda and Saudi Arabia’s net-zero goals push eco-friendly designs. Developments with solar panels and recycled materials attract 60% of millennial buyers, reducing utility costs by 15%. Government incentives, including $1 billion in sustainability funds, support green certifications, while 80% of new projects in Jeddah incorporate energy-efficient systems, aligning with environmental regulations and appealing to the GCC’s environmentally conscious urban demographic.

Urbanization and tourism growth propel 40% of residential demand, with the GCC market valued at $64.5 billion. Saudi Arabia’s unified GCC visa and 150 million annual visitors drive housing needs in tourist hubs like Dubai, backed by 6% annual expansion. Mega-projects like Qiddiya increase property investments, with 65% of transactions for luxury villas and apartments, catering to high-net-worth individuals and expatriates in a region with $2.8 trillion in financial wealth.

GCC Residential Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Apartments and Condominiums

● Villas and Landed Houses

Country Insights:

● Saudi Arabia

● United Arab Emirates

● Qatar

● Kuwait

● Oman

● Bahrain

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=21182&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Residential Real Estate Market

● August 2025: Omnia Capital Group’s GCC Property Wealth Report forecasts 10-15% prime residential price growth in Dubai, Abu Dhabi, and Riyadh, driven by 18,000 HNWIs relocating to the region amid sustained investor confidence.

● September 2025: Oman’s residential real estate prices surge 11.8% year-on-year in Q2, with Muscat Governorate leading at 38.1% growth in land values, supported by urbanization and infrastructure boosts.

● July 2025: Markaz’s real estate outlook predicts upward momentum in UAE, Saudi Arabia, and Kuwait markets through H2, with Dubai’s rental yields hitting 7.6% and AED 142 billion in Q1 sales.

● February 2025: Sakan releases inaugural GCC Residential Market Report, revealing $383 billion in 2024 transactions, with Qatar’s hospitality additions of 845 rooms signaling strong residential spillover effects.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Australia Real Estate Investment Market: Investment Momentum and Key Developments

in UncategorizedMarket Overview

The Australia Real Estate Investment Market was worth USD 229.1 billion in 2024, and is projected to reach USD 424.7 billion by 2033, growing at a CAGR of about 7.10% over 2025-2033. Key sectors attracting investment include residential, commercial, land, and industrial/ logistics data-driven properties.

Key drivers cited for this growth are:

Key Trends & Market Drivers

Australia’s population is increasing rapidly. For example, in 2024, the population growth was ~2.3%, with over 600,000 additional people, largely driven by overseas migration. This fuels demand for housing and rental properties.

Cross-border investment in commercial real estate has surged. In Q1 2025, APAC cross-border transactions more than doubled year-on-year, with Australia being a major destination.

With rental affordability issues and strong demand for rental properties, investors are increasingly backing build-to-rent projects. Co-living and multi-unit dwellings are also gaining interest.

Policies around taxation, incentives, zoning, and sustainable building are influencing investment decisions. Investors are looking for stable regulatory frameworks.

Interest Rate Movements & Financial Costs

Lower interest rates in some periods, or expectations thereof, improve borrowing conditions. In 2025, several rate reductions (e.g. February and May) have helped ease some pressure in property financing.

Luxury & Regional Market Shifts

Premium & luxury segments are realigning: some regional markets (e.g., coastal Queensland, Sunshine Coast) are increasingly entering the “million-dollar median” territory, shifting perceptions of what’s “luxury” geography.

Opportunities in the Australian Real Estate Investment Market

As metropolitan markets get more saturated and expensive, regions like Southeast Queensland, Perth, and other growth corridors offer attractive yields and rising property values.

Long-term rental stability is becoming more appealing. Institutional investors tapping into BTR and co-living can achieve stable returns and fill gaps in rental supply.

The growth of e-commerce and demand for supply chain infrastructure underscores opportunities in warehouses, logistics facilities, and data centers.

There’s rising interest in ESG-compliant properties, energy-efficient/responsible construction, and green certifications. Properties with lower operating costs and appeal to eco-aware tenants or buyers will likely see premium valuation.

Australia remains a favored destination for foreign investors in real estate, especially when borders are open and policy is favorable. Targeted projects that appeal to overseas capital (e.g. hospitality, high-end residential, commercial) can benefit.

Mixed-use developments (residential + retail + offices), strata or co-ownership models, and properties that allow flexible use are attractive as consumer preferences shift.

Recent News & Developments

June 2025 – Housing Prices Reach Historic High

In March 2025, average house prices across Australia breached AUD 1 million for the first time. The total residential property market was valued at AUD 1.4 trillion+. Strong population growth, infrastructure investment, and urban density were key influences.

Late 2024 / Early 2025 – Surge in Cross-Border Commercial Real Estate Investment

In Q1 2025, cross-border investment in commercial real estate in the Asia-Pacific region more than doubled year-on-year, with Australia being one of the major recipients. Logistics and industrial sectors were prominent.

2024 & 2025 – Rise in Build-to‐Rent & Co-Living Projects

Institutional investors have increasingly backed Build-to-Rent (BTR) developments. As of Q4 2024, thousands of BTR units were completed, under construction, or approved in states like Victoria, NSW, and Queensland. Co-living also started to draw investor interest due to affordability pressures.

2025 – Interest Rate Cuts Spark Renewed Investor Confidence

Interest rates were reduced in February and May 2025, improving borrowing conditions. This has led to a modest rebound in investment activity, especially in regions outside the high-cost city centers.

2025 – Luxury & Regional Median Prices Rising

Several regional areas, especially coastal and lifestyle markets (Sunshine Coast, Gold Coast), have joined or are approaching the “$1 million median house price” club. Luxury top-price brackets are shifting due to lifestyle demand and remote work flexibility.

Market Insights:

Real estate investment in Australia is not just an indicator of economic health—it’s a key driver of capital flow, urban planning, and societal trends. For investors, the blend of capital appreciation, rental income, and emerging sectors such as logistics, BTR, and sustainable development offers multiple entry points. As housing demand continues to evolve under pressures of affordability, migration, and climate, the ability to adapt strategy will separate successful portfolios from underperforming ones.

Local realtors say lowered interest rates are positively impacting the Lubbock housing market

in UncategorizedBoomers still rule U.S. real estate market, owning double what millennials do

in UncategorizedA new study reveals a stark generational divide in American wealth—especially when it comes to real estate. Baby boomers now hold 40.9% of all U.S. real estate, nearly twice as much as millennials, who own just 20.4%.

The findings come from a report by Self Financial, which examined decades of Federal Reserve data to highlight long-standing wealth gaps between generations.

Boomers also own over $19.6 trillion in real estate, compared to $9.79 trillion for millennials. While Generation X—now in their late 40s to early 60s—owns 29.4%, they’re still trailing behind what boomers owned at the same age.

Boomers are still five times wealthier than millennials

The report found that baby boomers are collectively 5.2 times wealthier than millennials. They currently own more than half of the nation’s total wealth (51.7%), while millennials account for just 9.8%.

Even though millennials are doing better than Generation X did at age 35—by about 109%—they still face significant challenges building wealth. Skyrocketing home prices and changing job markets are key factors holding them back, researchers say.

Wealth isn’t spread equally

The study also points out that wealth is highly concentrated at the top. According to recent Congressional Budget Office data, the richest 10% of Americans control 60% of total wealth, while the bottom half holds just 6%.

Boomers’ wealth is mostly spread across real estate, equities, pensions, and private businesses. Millennials, on the other hand, have a much larger share of their net worth tied up in real estate—and far less in stocks and retirement savings.

By the numbers: real estate ownership by generation

The report concludes that even though younger generations are building wealth faster than previous generations at the same age, the overall gap between generations remains wide—especially when it comes to housing.

You can view the full report and methodology at: https://www.self.inc/info/generational-wealth-gap/

Get the latest headlines delivered to your inbox each morning. Sign up for our Morning Edition to start your day. FL1 on the Go! Download the free FingerLakes1.com App for iOS (iPhone, iPad).

FingerLakes1.com is the region’s leading all-digital news publication. The company was founded in 1998 and has been keeping residents informed for more than two decades. Have a lead? Send it to [email protected].

New listings fall sharply as September market cools off

in UncategorizedNAR Report Indicates Sluggish Trends

in UncategorizedIf you’re keeping an eye on the real estate world, you’ve likely noticed things have felt a bit… slow. And you’re right. The latest data from the National Association of REALTORS® (NAR) confirms that the housing market remains sluggish with a dip in home sales in August. While the change might seem small – just a 0.2% drop from July – it adds to a picture of a market that’s still finding its footing. What does this mean for you, whether you’re thinking about buying a home or selling the one you have? Let’s dive in.

Housing Market Update 2025: NAR Report Indicates Sluggish Trends

These shifts, even small ones, are important signals. They often point to larger forces at play, like interest rates, the number of homes available, and how much people can afford. The fact that sales decreased slightly in August, reaching a seasonally adjusted annual rate of 4.0 million, tells us that the buying frenzy we saw not too long ago has definitely cooled.

A Closer Look at the Numbers: What Did August Show Us?

The NAR’s Existing-Home Sales Report is like a regular health check for the housing market. It gives us a clear snapshot of where things stand. Here’s a breakdown of what August revealed:

Why the Slowdown? It’s All About the Money and the Homes.

Lawrence Yun, NAR’s Chief Economist, hit the nail on the head. He pointed to two big reasons for this sluggishness: elevated mortgage rates and limited inventory. And honestly, that’s been the story for a while now.

Regional Differences: Not All Markets are Created Equal

What’s happening in the housing market isn’t uniform across the country. Some areas are feeling the slowdown more than others.

It’s always important to remember that national statistics are just averages. Your local housing market could be behaving quite differently, so keeping an eye on your specific area is crucial.

What About Home Prices? They’re Still Going Up (Mostly).

Despite the sluggish sales, home prices continue to show resilience. The median existing-home price for all housing types hit $422,600. That’s a 2.0% increase from last year. This marks the 26th consecutive month of year-over-year price increases.

This might sound confusing: why are prices still going up if sales are slow? It largely comes back to inventory. When the supply of homes is tight, even with fewer buyers, sellers can often hold firm on prices, and sometimes even see increases. However, the rate of price growth has certainly slowed compared to the booming market of a few years ago.

Who’s Buying and Selling? A Look at the Buyers

The report also gives us insights into who’s making moves in the market:

My Take: What This Means for You

From my perspective, this data paints a picture of a market that’s trying to find a new balance. It’s not the red-hot seller’s market of a few years ago, nor is it a buyer’s dream market either.

Looking Ahead: What to Watch For

The future of the housing market hinges on a few key factors:

The NAR’s Chief Economist, Lawrence Yun, is optimistic that declining mortgage rates and increasing inventory will boost sales in the coming months. He also noted that while the upper end of the market might benefit from homeowners’ increased wealth, the lack of affordable inventory will continue to constrain sales at the lower end.

The housing market is a complex beast, always influenced by a multitude of economic and social factors. While August showed us a market that’s still taking its time, it’s also a market that shows signs of potential improvement as interest rates ease and more homes come online. Keep an eye on these trends; they’ll tell us more about where the market is headed next.

Invest in Real Estate in the Top U.S. Markets

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact Norada today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Get Started Now