Houston home sales tumbled at the end of 2022

When former Texas residents Barbara and Frank Israel wanted a place to retire last year, they knew they no longer could afford to live on San Juan Island, a picturesque enclave near Seattle.

So they decided to move to Houston and began looking for a home in January 2022, expecting a market like they experienced when they bought a home in Houston in the mid-1990s. What they found was radically different.

The competition in their price range — under $300,000 — was fierce in early 2022, with some homes disappearing off the market within hours of being listed. Sixteen failed offers and four months later, they wrote a personal letter appealing to the sellers of an older Conroe home. The effort worked, but they paid about $17,000 above asking price to close on the home in May, even though it needed significant renovations.

“Interest rates were already going up and we had to pull money out of savings to fix up the home,” said Barbara Israel, 64. They don’t think they could have afforded the same house if they had to pay today’s standard 6 to 7 percent mortgage rate now. “We would have to buy much less house or look in a different neighborhood,” said Frank, 72.

The Israels consider themselves lucky to just barely missed being caught in the crosshairs of a shifting market in 2022, The first half of the year saw the continuation of the sales boom unleashed by historically low mortgage rates earlier in the pandemic. But in the spring, the frenzied for-sale market started fizzling out as mortgage rates climbed in the wake of the Federal Reserves’ efforts to rein in inflation by raising its benchmark interest rates. Rising mortgage rates added hundreds of dollars to monthly payments, pricing out many buyers in Houston and forcing others to downgrade their purchases to smaller, older houses.

RENTING:The topsy turvy real estate market as more would-be homebuyers saying ‘no thanks, for now’

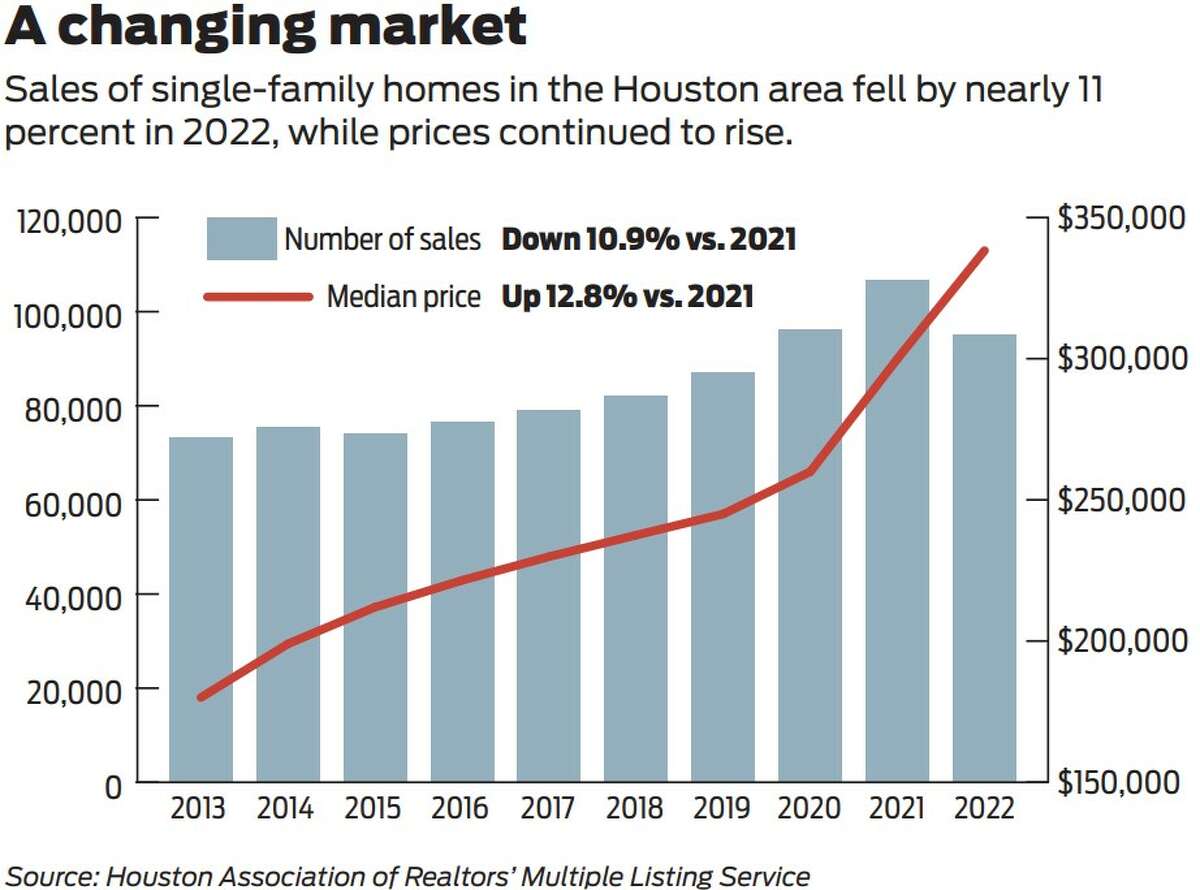

By the end of the year in Houston, total sales volume slipped almost 11 percent compared with 2021’s record sales volume — marking the first annual decline in home sales in Houston since 2015, according to a new report from Houston Association of Realtors. But despite the slowdown in sales, limited inventory has kept home prices stubbornly high by Houston standards. The average home price hit $409,777 and the median price hovered at $330,000 in December, up 5.1 percent and 3.8 percent, respectively, compared with the same time last year.

What happens in Houston’s real estate market in 2023 will largely depend on the fate of the economy as the nation lumbers toward a recession. Mortgage rates are expected to fall slightly, but not to the historically low levels seen in the pandemic. Coupled with persistently high home prices in Houston and fears of a possible recession, sales aren’t expected to rebound to levels of recent years. Instead, the market is returning to activity levels seen in the years leading up to the pandemic.

“I want to be positive, but we also have to be realistic, that there are concerns like interest rates and a recession that are weighing heavy on us,” said Cathy Trevino, chair of Houston Association of Realtors and a real estate broker with Side Inc. But that doesn’t necessarily mean a drastic real estate downturn is in store. “I believe we’ll see the market come down, but more gradually. And we’re fortunate to be in Houston, which has a very strong economy.”

Retirees Frank and Barbara Israel found an unexpectedly competitive real estate market when they moved back to Houston in early 2022, just barely missing the steepest mortgage rates hikes in the middle of the year.

Courtesy Barbara Israel

2022 roller coaster

Home sales started sliding in Houston in April 2022 and have fallen every month since then. In December home sales tanked by nearly 33 percent compared with December 2021, according to the HAR report.

The slowdown in sales is happening even as prices remain elevated. Limited inventory and strong demand pushed average prices to a record high of $438,301 in May, while median home prices hit a record $353,995 in June. While median prices drifted down to $330,000 by October, and have remained there since then, median home prices are still about 31 percent higher than they were in December 2019, according to HAR data.

Although median home prices are up nearly 13 percent in 2022, sales volume contracted by nearly 11 percent, according to Houston Association of Realtors.

Monte Bach/Staff graphic

Even some real estate agents had to compromise on their dream homes last year, as mortgage rates climbed. Aaron Dailey, a Realtor with Houston Properties Team, who also represented the Israels in their transaction, got the itch to buy a house with his husband in summer 2022. Despite Dailey’s background in real estate and slowing sales activity in the second half of the year, they found competition in their price range around $600,000 in north suburban Spring to be stronger than expected.

“If we wanted a house that has everything in it, we were really going to be spending at that upper tier of our budget, and as things were shifting, and we were hearing noise in the market about interest rates continuing to rise and inflation, we just didn’t feel comfortable with that,” said Dailey, 29.

They were outbid on three homes before focusing on properties that had been on the market longer. And they let go of several wish-list items. Eventually, they paid $70,000 under asking price for a home that had been on the market for 60 days. Though the design was outdated and the interior needed new paint, Dailey said they were happy with the home’s location near family in the City Place development.

NEW HOMES: Prices are flattening for new home construction as inventory builds

The Daileys’ story is one example of how certain suburbs like Spring, The Woodlands and Katy are still seeing relatively strong sales despite a broader slowdown in the market, Realtors say. For buyers to find something within their budget amid higher mortgage rates, Dailey encourages his clients to find listings that have been on the market for a while or older homes that need a little more TLC.

Sellers also need to realign their expectations. The price their neighbor got for a house in 2021 likely wouldn’t be the same today, Realtors say.

“The past two years were a gift of the real estate Gods,” Dailey said. “It was an anomaly.”

Johnny Dailey, left, and Aaron Dailey, right, talk about painting the kitchen cabinets and other changes they have made in their home shown Tuesday, Jan. 10, 2023, in Spring.Melissa Phillip/Staff Photographer

Johnny Dailey, left, and Aaron Dailey, right, talk about painting the kitchen cabinets and other changes they have made in their home shown Tuesday, Jan. 10, 2023, in Spring.Melissa Phillip/Staff Photographer

What to expect

Many economists say they expect a mild recession to unfold over the first half of the year, which could weaken homebuying activity. A lot, however, will depend on the job market. People won’t buy houses if they believe they are in danger of losing their jobs.

So far, Houston has been somewhat insulated from recent sizable layoffs by technology firms, and major oil and gas companies are turning out record profits. The Greater Houston Partnership said it anticipates Houston adding a net total of 60,800 jobs in 2023 — within a normal range when compared with pre-pandemic levels for the region. Although local December job numbers haven’t been released, a national report showed job growth exceeded analysts’ expectations.

Strong job growth coupled with inflation means the Federal Reserve likely isn’t done raising interest rates. While mortgage rates as a result may rise in the short term, economists at the Mortgage Bankers Association and Bankrate say they expect the average rate for a 30-year fixed loan to fall to about 5.2 to 5.25 percent by the end of 2023.

If mortgage rates do fall below 6 percent this year, that could revive home sales, particularly in areas where home prices are leveling off but wage growth and employment remain strong, said Rick Sharga, executive vice president at real estate data firm ATTOM.

“If we have a combination of softening prices for homes, slightly lower mortgage rates and rising wages, we should start to see the sales market for homes pick up a little again,” Sharga said. “Will we go back to 2021 levels? Probably not.”

INVENTORY RISING: Prices for new homes in Houston are flattening

The National Association of Realtors predicts that existing home sales will slow by 6.8 percent this year, with median prices remaining nearly flat. But the Mortgage Bankers Association said it foresees a decline of almost 13 percent for existing home sales, along with a 4 percent decline for new-home sales.

Locally, Houston Properties Team with Keller Williams, which produces an annual forecast with about 72 percent accuracy, is forecasting Houston home sales to stumble to levels seen in 2016 to 2017. That could mean sales volume falling by 10 to 18 percent in Houston this year compared with last year’s numbers, according to the Houston Properties Team. But the firm forecasts that Houston’s median home price to tick up by about 3 percent compared with 2022. That would be a much slower pace of price growth than earlier in the pandemic, but still a modest increase.

Silver lining

The good news for buyers is that they will face far less competition and find more selection than they did in 2021. Houston has about 2.7 months of inventory — meaning it would take that long to sell through all the homes on the market if sales continued at their current pace. That’s a noticeable gain from the 1.4 months of supply in December 2021, although still far below the 6 months’ worth of inventory that would characterize the market as balanced.

A typical home in Houston is now sitting on the market for 57 days, compared with 38 days at the same time last year and 26 days at the height of the pandemic real estate boom in July 2021.

“I think sellers are coming to terms now that homes are sitting on the market a little bit longer,” Trevino said. “We have the opportunity now to where buyers can actually come in and ask for things, you know, ask for lower price, ask for seller concessions, ask for a home warranty or repairs. Buyers have a little more power.”

marissa.luck@chron.com

Leave a Reply

Want to join the discussion?Feel free to contribute!