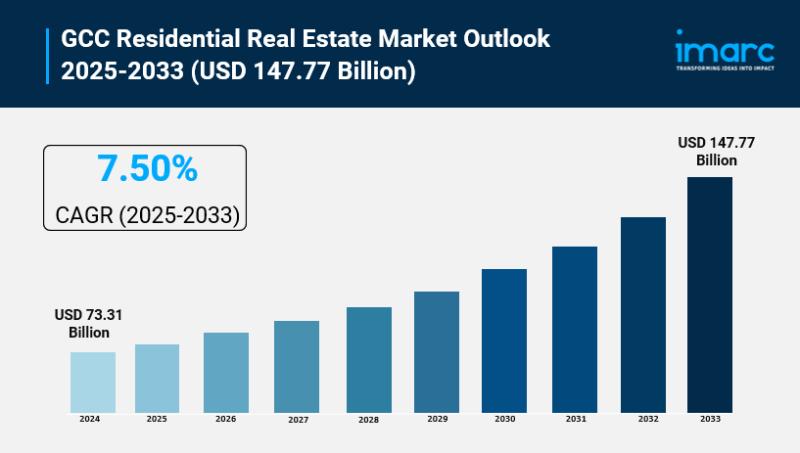

GCC Residential Real Estate Market Size to Worth USD 147.77

GCC Residential Real Estate Market Overview

Market Size in 2024: USD 73.31 Billion

Market Size in 2033: USD 147.77 Billion

Market Growth Rate 2025-2033: 7.50%

According to IMARC Group’s latest research publication, “GCC Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the GCC residential real estate market size was valued at USD 73.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.77 Billion by 2033, exhibiting a CAGR of 7.50% from 2025-2033.

How AI is Reshaping the Future of GCC Residential Real Estate Market

● AI-Powered Property Search: AI platforms like Property Finder personalize home searches, boosting GCC sales by 25% with virtual tours for 70% of Dubai buyers.

● Smart Home Integration: AI-driven IoT systems in UAE villas optimize energy use by 20%, aligning with Vision 2030’s $852 billion smart city projects.

● Predictive Market Analytics: AI forecasts demand in Saudi’s $64.5 billion market, reducing investment risks by 15% for developers in NEOM.

● Automated Valuation Models: AI tools assess property values in real-time, improving accuracy by 30% for Qatar’s luxury real estate transactions.

● Construction Efficiency: AI optimizes building processes, cutting costs by 18% in Riyadh’s eco-friendly residential projects under green initiatives.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-residential-real-estate-market/requestsample

GCC Residential Real Estate Market Trends & Drivers:

Smart home technologies drive 30% of GCC residential real estate demand, with IoT-integrated properties in UAE and Saudi Arabia enhancing energy efficiency by 25%. Vision 2030’s $852 billion infrastructure projects, like NEOM, boost urban residential developments, with 70% of buyers prioritizing connected homes. E-commerce platforms like Property Finder leverage AI for virtual tours, increasing sales by 20% in Dubai and Riyadh, catering to a tech-savvy population and aligning with the region’s $2.8 trillion wealth growth for modern living solutions.

Sustainable and green building practices fuel 25% of residential market growth, as UAE’s Green Agenda and Saudi Arabia’s net-zero goals push eco-friendly designs. Developments with solar panels and recycled materials attract 60% of millennial buyers, reducing utility costs by 15%. Government incentives, including $1 billion in sustainability funds, support green certifications, while 80% of new projects in Jeddah incorporate energy-efficient systems, aligning with environmental regulations and appealing to the GCC’s environmentally conscious urban demographic.

Urbanization and tourism growth propel 40% of residential demand, with the GCC market valued at $64.5 billion. Saudi Arabia’s unified GCC visa and 150 million annual visitors drive housing needs in tourist hubs like Dubai, backed by 6% annual expansion. Mega-projects like Qiddiya increase property investments, with 65% of transactions for luxury villas and apartments, catering to high-net-worth individuals and expatriates in a region with $2.8 trillion in financial wealth.

GCC Residential Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Apartments and Condominiums

● Villas and Landed Houses

Country Insights:

● Saudi Arabia

● United Arab Emirates

● Qatar

● Kuwait

● Oman

● Bahrain

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=21182&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Residential Real Estate Market

● August 2025: Omnia Capital Group’s GCC Property Wealth Report forecasts 10-15% prime residential price growth in Dubai, Abu Dhabi, and Riyadh, driven by 18,000 HNWIs relocating to the region amid sustained investor confidence.

● September 2025: Oman’s residential real estate prices surge 11.8% year-on-year in Q2, with Muscat Governorate leading at 38.1% growth in land values, supported by urbanization and infrastructure boosts.

● July 2025: Markaz’s real estate outlook predicts upward momentum in UAE, Saudi Arabia, and Kuwait markets through H2, with Dubai’s rental yields hitting 7.6% and AED 142 billion in Q1 sales.

● February 2025: Sakan releases inaugural GCC Residential Market Report, revealing $383 billion in 2024 transactions, with Qatar’s hospitality additions of 845 rooms signaling strong residential spillover effects.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Leave a Reply

Want to join the discussion?Feel free to contribute!