CubeSmart (CUBE): Revisiting Valuation After Analyst Upgrade on Housing Market Optimism

CubeSmart (NYSE:CUBE) is back in the spotlight after Evercore ISI upgraded the stock to ‘Outperform,’ pointing to what they see as an attractive valuation and optimism around the housing market. Evercore’s decision comes with the view that improving market conditions could give a welcome boost to CubeSmart’s revenue in the coming year, a sentiment many investors may find reassuring after a year that has prompted tough questions about where growth will come from. For those tracking REITs or real estate stocks, this is the sort of event that could nudge portfolios in a new direction.

In the bigger picture, CubeSmart’s stock has seen plenty of movement, with short-term gains giving way to a longer-term downswing. Over the last year, the shares have declined around 20%, despite pockets of positive momentum in recent weeks. Rising interest rates and competitive dynamics shaped the larger narrative, but annual revenue growth has held up, even if net income didn’t budge much. While CubeSmart’s three-year and five-year returns still look healthy, the past year suggests momentum has cooled for now.

So after this analyst-driven bump, is CubeSmart undervalued, set for a turnaround, or is the market already factoring in its growth story ahead of next year?

Most Popular Narrative: 10.5% Undervalued

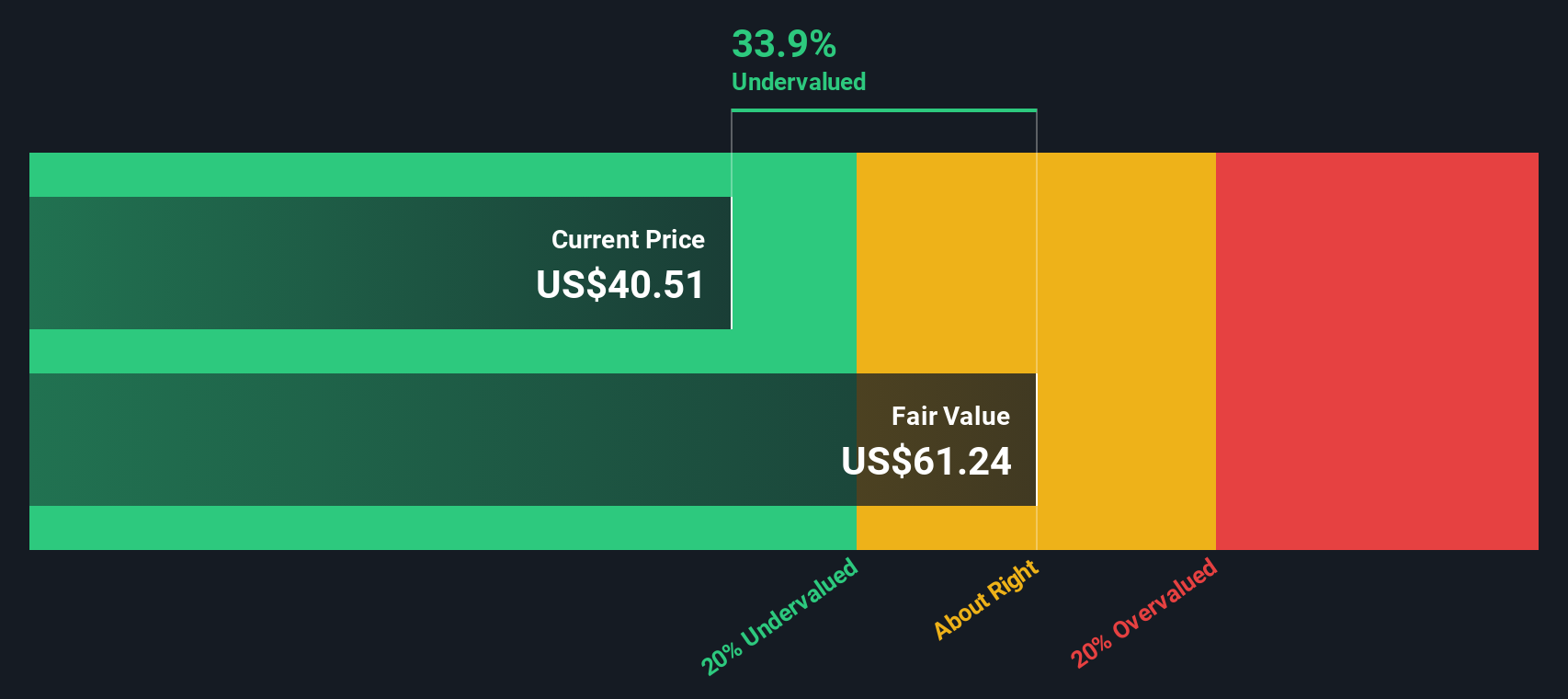

According to the most widely followed narrative, CubeSmart is trading below its estimated fair value, with analysts pointing to a sizeable upside potential if their assumptions hold true. The current share price is seen as not fully reflecting the company’s long-term growth prospects, even as short-term headwinds persist.

Improving fundamentals in key urban markets, especially along dense corridors like New York City, where demand is driven by a growing base of urban dwellers and small businesses coupled with limited new supply, are creating a stable, resilient occupancy base and sticky customer relationships. This environment may steadily lift revenue and net rental income as positive trends flow through the portfolio.

What is the financial engine fueling this bullish rating? Analysts are betting on a delicate balance of growth factors, from urban demand trends to future profitability assumptions. However, the real surprise lies in just how ambitious this narrative is about CubeSmart’s future margin trajectory and valuation multiple. Want to uncover the forecasts and financial math powering this undervaluation call? The numbers behind this outlook may just defy expectations.

Result: Fair Value of $45.28 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent new supply in Sunbelt regions or a slower recovery in move-in rates could dampen CubeSmart’s revenue growth and delay a margin rebound.

Find out about the key risks to this CubeSmart narrative.

Another View: Discounted Cash Flow Model

Taking a different approach, the SWS DCF model suggests CubeSmart’s value story could be even more compelling. This analysis frames the stock as undervalued by a wide margin. How might this change your perspective?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CubeSmart for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own CubeSmart Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can put together your own perspective in just a few minutes. Do it your way

A great starting point for your CubeSmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not last forever. Get ahead of the market and energize your portfolio by tapping into top investment trends using the Simply Wall Street Screener.

- Uncover potential bargains by scanning for undervalued stocks with cash flows on your side using our powerful tool for undervalued stocks based on cash flows.

- Tap into high-yielding opportunities and put your money to work with companies offering solid returns through dividend stocks with yields > 3%.

- Ride the next tech wave by searching for innovative small-cap companies at the cutting edge of artificial intelligence advancements with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply

Want to join the discussion?Feel free to contribute!